Part A Monthly Premium (For those not automatically enrolled)

- 0-29 qualifying quarters of employment: $471

- 30-39 quarters: $259

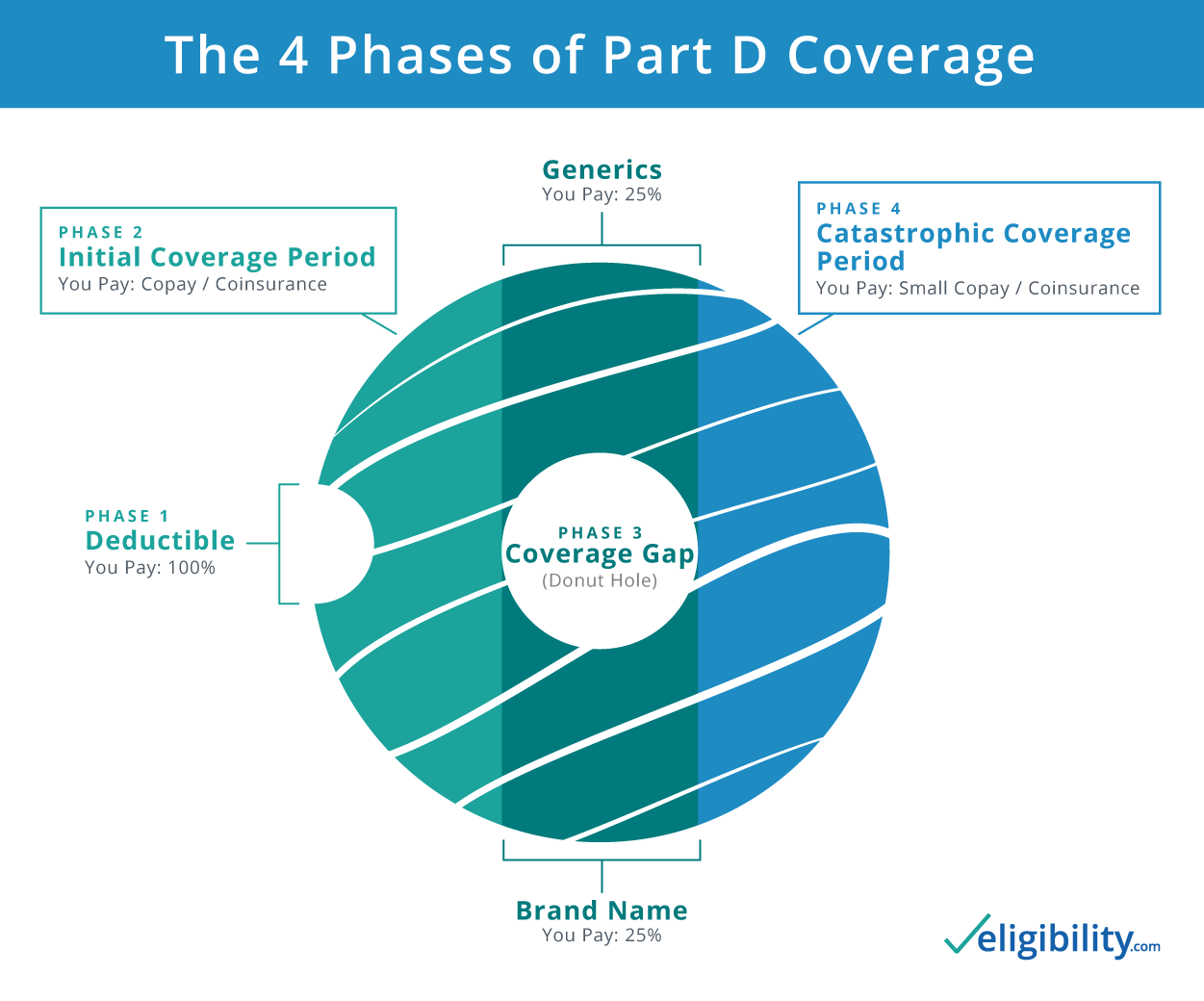

Medicare Deductible 2021 Part D

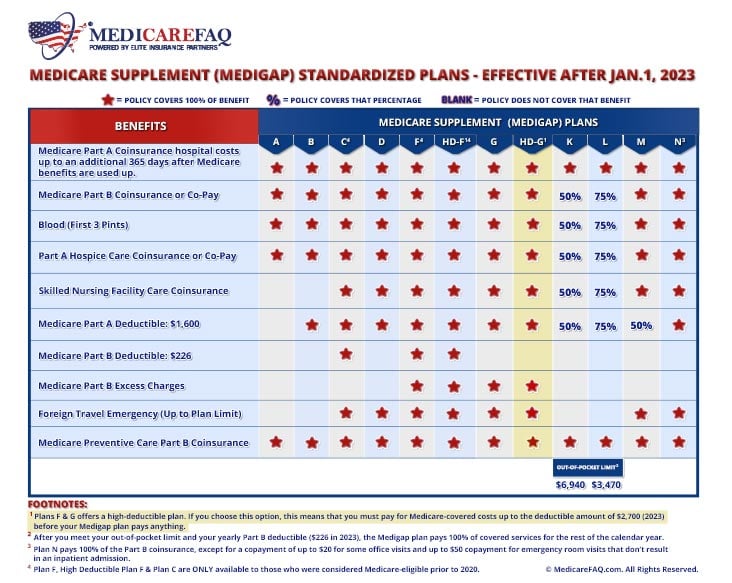

Income and Asset Limits 2021 Enrolled in Income limit Program Copayments Above $1,093 ($1,472 for couples) per month1 Full Extra Help $0 premium and deductible3 $3.70 generic copay $9.20 brand-name copay No copay after $6,550 in out-of-pocket drug costs Medicaid and/or a Medicare Savings Program Up to $1,093 ($1,472 for. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.).

Inpatient Hospital

- Deductible, Per Spell of Illness: $1,484

- Co-pay, Days 1 – 60: $0

- Co-pay, Days 61 – 90: $371/day

- Co-pay, Lifetime Reserve Days: $742/day

Skilled Nursing Facility

- Co-pay, Days 1 – 20: $0

- Co-pay, Days 21 – 100: $185.50

Standard Monthly Part B Premium

- $148.50

Part B Deductible

- $203

What Does Medicare Part B Cover

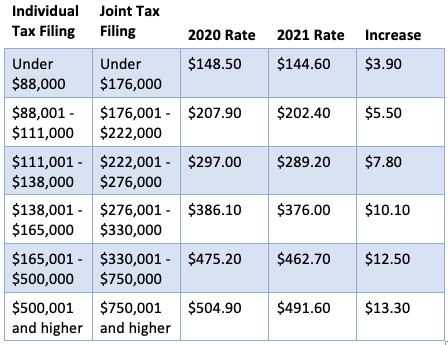

2021 Parts B and D Income-Related Premiums

Medicare Copay 2019 Snf

Note: Legislation passed in 2015 made changes to the income thresholds for 2018 and 2019 (the upper 3 brackets were lowered, meaning higher charges apply to people earning less income compared to previous years). For 2020 and thereafter, the thresholds are adjusted annually for inflation. See Section 402 of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA; Public Law 114-10).